idaho sales tax rate in 2015

Ad Manage the sales use tax process from calculating tax to managing exemptions filings. Non-property taxes are permitted at the local.

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Idaho has recent rate changes Fri Jan 01 2021.

. Counties and cities can charge an. An alternative sales tax rate of 6 applies in the tax region. Find your income exemptions.

Learn how Sovos can reduce audit penalties and increase efficiency. One important thing to know about Idaho income taxes. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax.

Lowest sales tax 6 Highest sales tax 9 Idaho Sales Tax. The top bracket went to 85 in the 1980s. Find your pretax deductions including 401K flexible account.

Some Idaho resort cities have a local sales tax in addition to the state sales tax. The total tax rate might be as high as 9 depending on local municipalities. Click any locality for a full breakdown of local property taxes or visit our Idaho sales tax calculator to lookup local rates by zip code.

Most property tax measures. Idaho State Tax Commission. How to Calculate 2015 Idaho State Income Tax by Using State Income Tax Table.

Prescription Drugs are exempt from the Idaho sales tax. 280 rows 2022 List of Idaho Local Sales Tax Rates. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

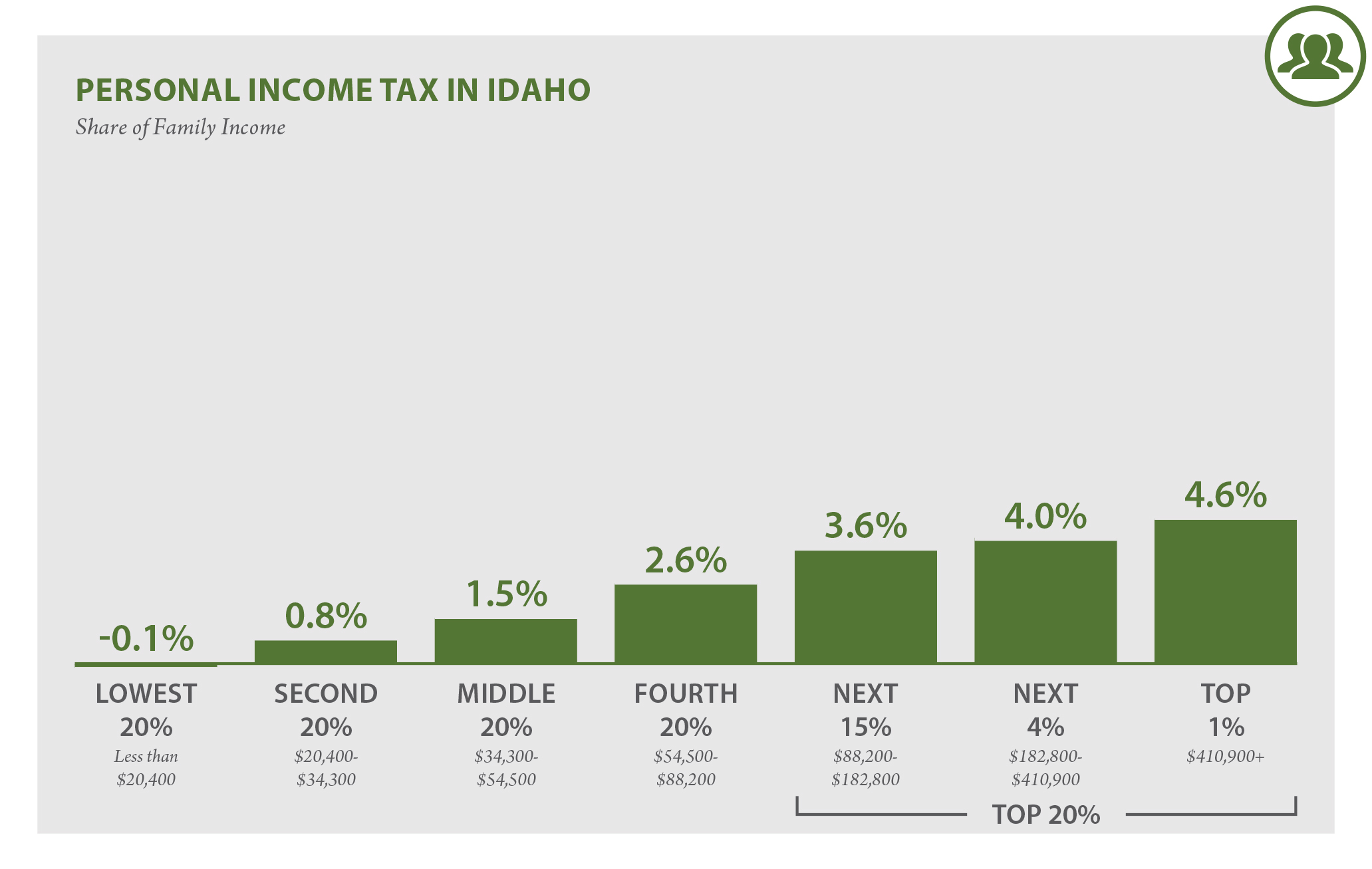

While many other states allow counties and other localities to collect a local option sales tax Idaho does. If you need access to a database of all Idaho local sales tax. During the 1980s and early 1990s Idahos income tax structure was one of the most progressive in the United States.

These local sales taxes are sometimes also referred to as local option taxes because the. With local taxes the total sales tax rate is between 6000 and 8500. Idaho has state sales tax of.

31 rows The state sales tax rate in Idaho is 6000. Average Sales Tax With Local. An alternative sales tax rate of 6 applies in the tax region Ada which appertains to zip codes 83702 83709 83712 and 83713.

The current state sales tax rate in Idaho ID is 6.

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

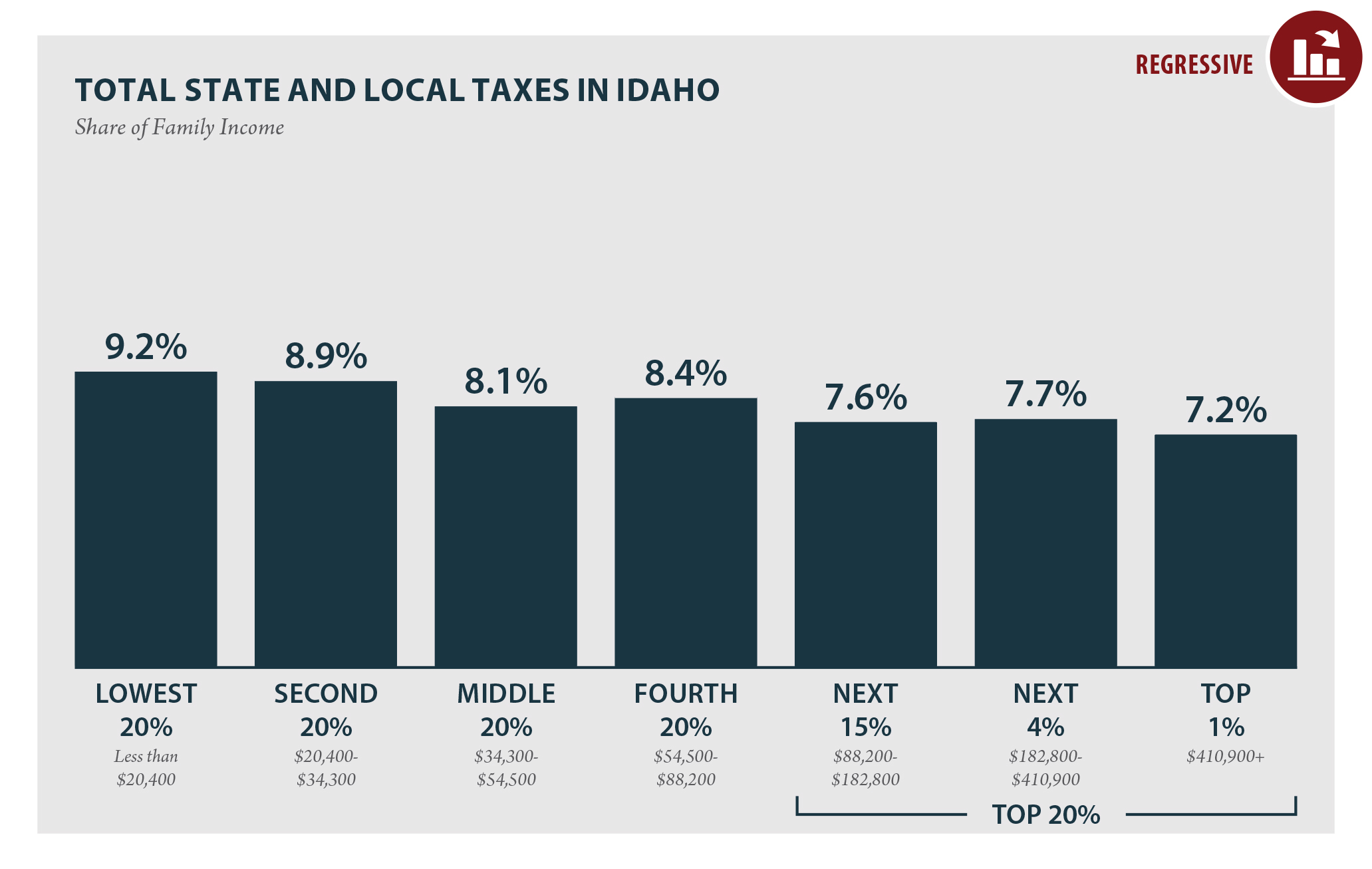

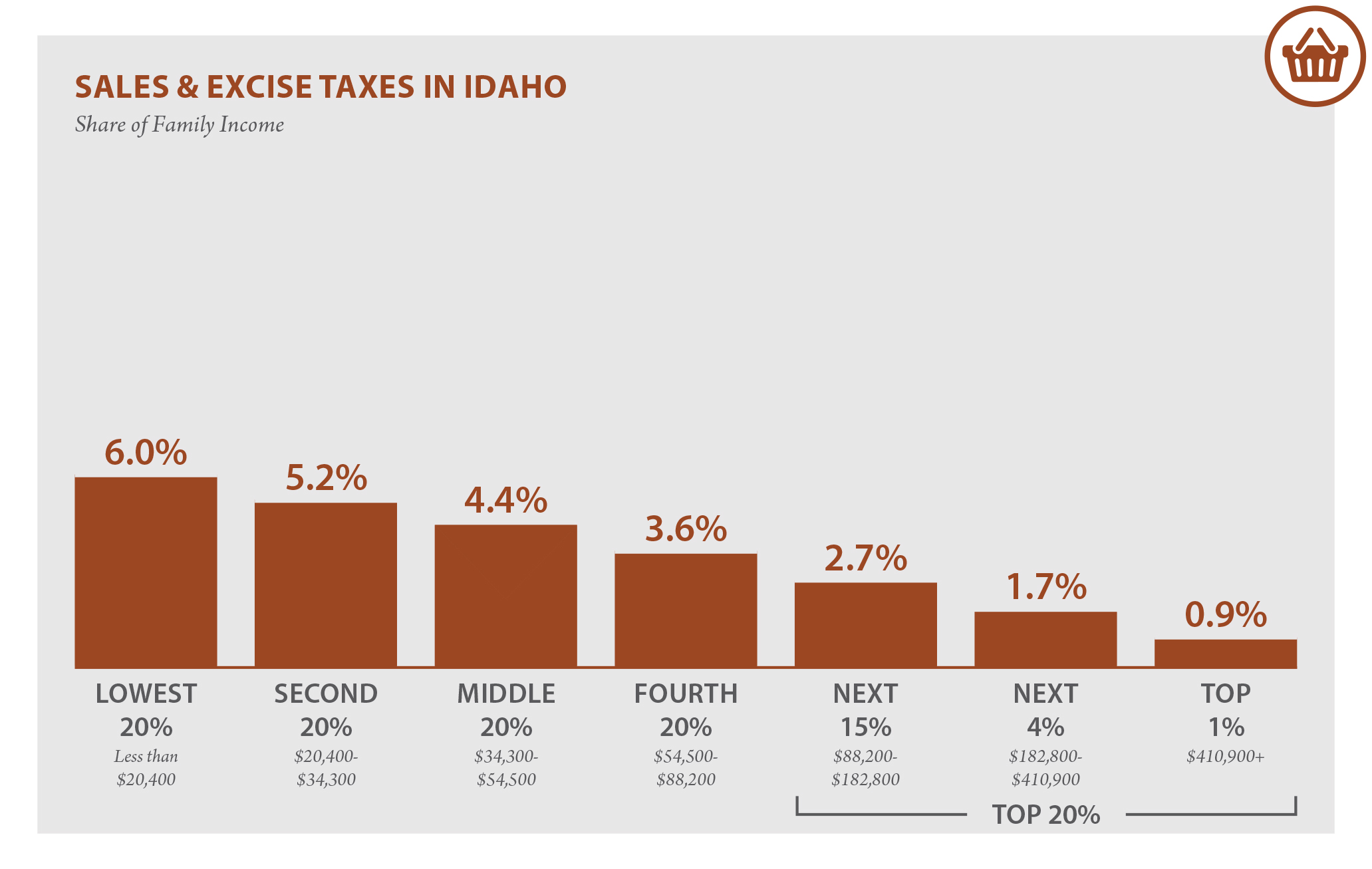

Idaho Who Pays 6th Edition Itep

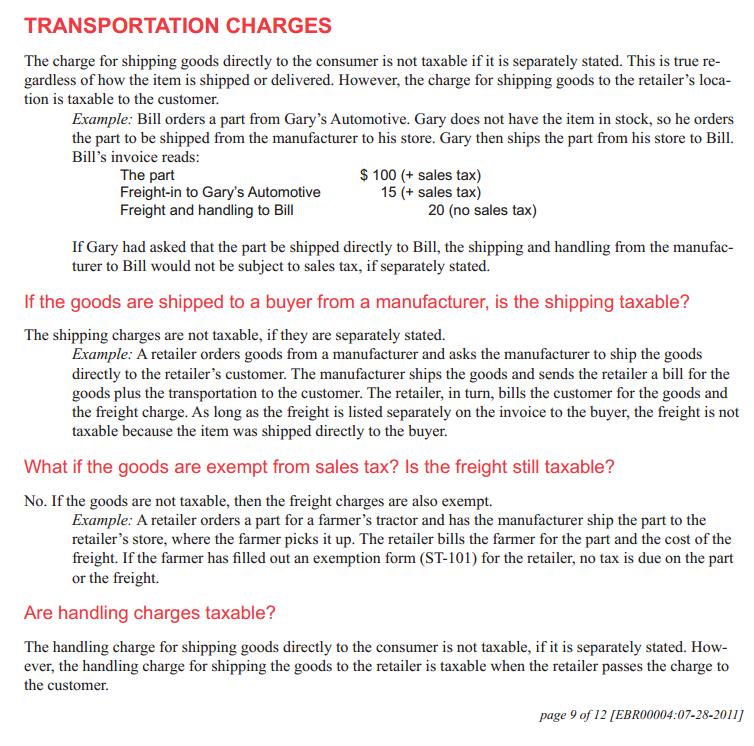

Is Shipping Taxable In Idaho Taxjar

Historical Idaho Tax Policy Information Ballotpedia

Sales Tax By State Is Saas Taxable Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

State Corporate Income Tax Rates And Brackets Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

Idaho Who Pays 6th Edition Itep

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Combined State And Local General Sales Tax Rates Download Table

Idaho Who Pays 6th Edition Itep

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio